Introduction

Welcome to the dynamic world of freelancing, where your unique skills and independence shape your career. However, this independence often comes with the challenge of managing an irregular income. Navigating the financial ups and downs is a common hurdle for many in this field. But fear not, as you’re not alone in facing these challenges.

In our comprehensive guide, “Mastering Your Finances,”, we focus on the essential aspects of financial management specifically designed for freelancers. This guide offers you practical strategies and sound advice to help you maintain financial stability amidst the natural ebbs and flows of freelance income. We’re here to provide insights and support, enabling you to manage your finances with confidence and clarity.

Whether you’re a well-established freelancer or just beginning your journey, this guide serves as a valuable resource for understanding and managing the nuances of irregular income. Join us as we embark on this journey together, paving the way for a more secure and successful freelance career.

Navigating the Challenge of Irregular Income

The life of a freelancer is often marked by a rollercoaster of financial highs and lows. One month, your inbox might overflow with projects, and the following month could be startlingly quiet. This fluctuating income stream is a hallmark of freelance work, bringing with it a unique set of financial challenges.

- The Uncertainty of Income Streams: Unlike traditional 9-to-5 jobs, freelancers can’t always predict when the next paycheck will come. This unpredictability makes budgeting and financial planning more complex.

- Managing Cash Flow: Ensuring that there is enough money in the bank to cover both professional and personal expenses, especially during lean periods, is a crucial skill for freelancers.

- Planning for Taxes: With irregular income, estimating and setting aside money for taxes becomes a challenge. It’s easy to fall into the trap of spending what you earn without considering the tax implications.

- Saving for the Future: While dealing with immediate financial obligations, it’s also important to think about long-term goals, such as retirement savings or investing in growth opportunities.

Strategies for Overcoming Financial Fluctuations

Despite these challenges, there are several strategies freelancers can employ to manage their finances more effectively.

- Building a Buffer Fund: One of the first steps is to create a safety net. This fund acts as a cushion during times when work is sparse, helping to cover essential expenses.

- Smart Budgeting: Developing a budget that accounts for both fixed and variable expenses is key. By understanding your spending patterns, you can make more informed financial decisions.

- Regular Financial Reviews: Keeping a close eye on your financial status is crucial. Regular reviews of income, expenses, and savings help in making adjustments as needed.

- Tax Planning: Working with a financial professional like Jason Arsenault CPA, LLC, can provide invaluable guidance in navigating the complexities of tax planning for freelancers.

- Diversifying Income Sources: Exploring different avenues for income can provide a buffer against slow periods. This could include passive income streams or taking on different types of projects.

Case Study: Emma, the Graphic Designer – Mastering Financial Stability Amidst Irregular Income

The Freelance Journey of Emma

Meet Emma, a talented freelance graphic designer known for her creative flair and eye-catching designs. Emma’s journey as a freelancer is a testament to both her artistic skills and her entrepreneurial spirit. However, like many freelancers, Emma’s path has not been without financial hurdles, particularly due to the irregular nature of her income.

Facing the Financial Challenges

- Unpredictable Project Flow: Emma’s work is project-based, with some months bustling with client demands and others worryingly quiet. This uneven workflow leads to an unpredictable income stream, making financial planning a daunting task.

- Managing Cash Flow: Balancing her business expenses with personal living costs during periods of reduced income posed a significant challenge for Emma. She often found herself dipping into savings to cover basic expenses.

- Navigating Tax Obligations: With fluctuating income, Emma struggled to accurately estimate and set aside funds for taxes, leading to stress during tax season.

Turning Challenges into Opportunities

Recognizing these challenges, Emma decided to seek professional help from Jason Arsenault CPA, LLC. Our firm worked closely with Emma to develop a comprehensive strategy tailored to her unique financial situation.

- Establishing a Buffer Fund: We advised Emma to build a buffer fund to provide financial security during lean periods. This fund helped Emma maintain a steady cash flow, regardless of her project pipeline.

- Implementing Effective Budgeting: We assisted Emma in creating a budget that accounted for her fluctuating income, ensuring she could meet both her business and personal expenses without compromising her savings.

- Tax Planning and Preparation: Our team provided Emma with expert tax advice, helping her understand her tax obligations and plan accordingly. This proactive approach alleviated the stress of tax season and helped avoid any unwelcome surprises.

- Diversifying Income Streams: We encouraged Emma to explore additional revenue sources, such as passive income opportunities and branching out into different design niches, to stabilize her income.

The Outcome

With these strategies in place, Emma experienced a significant transformation in her financial management. She gained confidence in her ability to handle the financial aspects of her freelance career, allowing her to focus more on her passion for design. Emma’s story is a powerful example of how professional financial guidance can turn the challenges of irregular income into opportunities for growth and stability.

Conclusion

Emma’s journey highlights the importance of strategic financial management for freelancers. If you’re facing similar challenges, Jason Arsenault CPA, LLC is ready to assist you. Our expertise in financial planning and tax strategies for freelancers can help you achieve the financial stability you need to thrive in your creative career.

Budgeting and Financial Planning: The Game Changer for Freelancers

The Role of Budgeting in a Freelancer’s Financial Health

As a freelancer, the key to achieving financial stability lies in effective budgeting and financial planning. This process not only helps in managing irregular income but also ensures long-term financial security and growth.

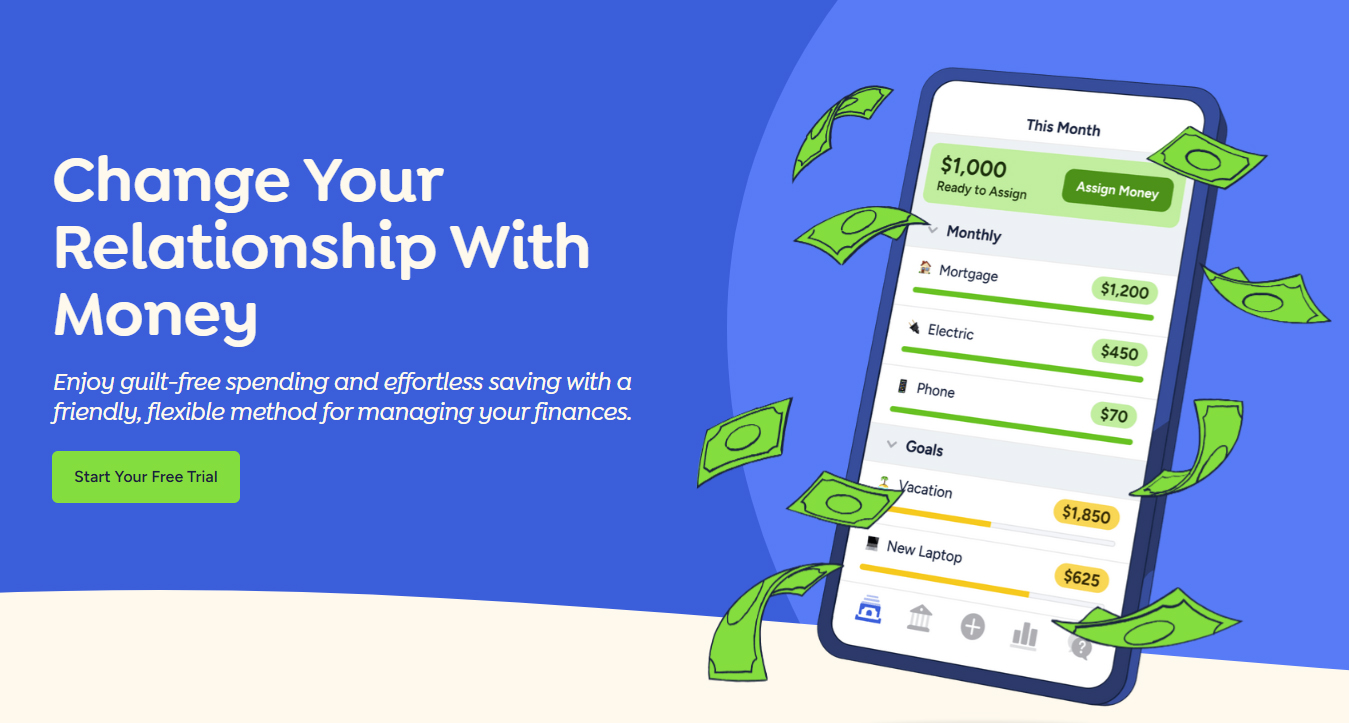

Introducing YNAB – A Tool Tailor-Made for Freelancers

You Need A Budget (YNAB) is a budgeting tool that has revolutionized the way freelancers manage their finances. YNAB operates on four simple rules:

- Give Every Dollar a Job: Allocate each dollar you earn to specific expenses, savings, or investments, ensuring you spend intentionally.

- Embrace Your True Expenses: Break down larger, less frequent expenses into manageable monthly amounts, avoiding financial surprises.

- Roll With the Punches: Be flexible and adjust your budget as needed, accommodating for the unpredictable nature of freelance income.

- Age Your Money: Aim to use income that you earned at least 30 days ago, creating a buffer and reducing reliance on immediate earnings.

How YNAB Works

YNAB connects to your bank accounts, allowing you to track all your income and expenses in one place. Its intuitive interface makes it easy to categorize transactions and plan for both regular and irregular expenses.

YNAB in Action: A Practical Example

Imagine Emma, our freelance graphic designer, earns $5,000 in a particularly good month. With YNAB, she allocates this income as follows:

- $2,000 for monthly living expenses (rent, groceries, utilities)

- $1,000 towards her buffer fund for leaner months

- $500 for her quarterly tax payment

- $500 for business expenses (software subscriptions, equipment maintenance)

- $1,000 into her savings for future investments

During a month with lower earnings, say $2,000, Emma can easily adjust her budget in YNAB. She prioritizes essential expenses and dips into her buffer fund, which she has built up during more prosperous months.

Conclusion

With tools like YNAB, freelancers like Emma can take control of their finances, making budgeting less of a challenge and more of a strategic advantage. By planning and tracking expenses with precision, freelancers can navigate through the ups and downs of their income streams with ease and confidence.

However, at Jason Arsenault CPA, LLC, we understand that each freelancer has unique needs and circumstances. While YNAB may be a fantastic solution for some, it might not fit everyone. Our role as your accountant is to find the solutions that work best for you. Whether it’s YNAB or another tool, we work collaboratively with our clients to identify and implement strategies that address their specific financial challenges. Our commitment is to provide personalized, effective solutions that help you achieve financial stability and success in your freelance career.

The Freelancer’s Financial Checklist: Mastering Your Finances

Navigating the world of freelance finance can be daunting. But with the right tools and strategies, it’s entirely manageable. Here’s a practical financial checklist designed to help freelancers like you stay on top of your finances and make informed decisions for your business.

- Track Your Income and Expenses Diligently

- Set up a system: Use a spreadsheet, accounting software, or a budgeting app to record every income and expense.

- Regular reviews: Schedule weekly or monthly times to review and categorize your transactions.

- Separate Personal and Business Finances

- Open a business bank account: This helps in tracking business transactions separately from personal ones.

- Use a dedicated credit card for business expenses: It simplifies record-keeping and tax filing.

- Create a Budget for Irregular Income

- Identify fixed monthly expenses: Rent, subscriptions, insurance, etc.

- Plan for variable expenses: Project materials, travel, marketing costs.

- Build a buffer fund: Save for lean months and unexpected expenses.

- Plan for Taxes

- Set aside money for taxes: Save a portion of each payment for tax obligations.

- Understand tax deductions: Know what expenses you can deduct to reduce your taxable income.

- Consult a tax professional: Regularly check in with an accountant to stay on top of tax changes and planning.

- Invest in Your Business Growth

- Allocate funds for professional development: Courses, workshops, networking events.

- Upgrade equipment and software when necessary: Stay competitive by keeping your tools and technology current.

- Prioritize Savings and Retirement

- Start a retirement fund: Consider IRAs or Solo 401(k)s tailored for freelancers.

- Emergency fund: Aim to have at least 3-6 months’ worth of living expenses saved.

- Regularly Evaluate and Adjust Your Financial Plan

- Quarterly financial reviews: Assess your financial performance and adjust your budget and goals accordingly.

- Seek professional advice: Regular meetings with a financial advisor or accountant can provide valuable insights and guidance.

- Protect Your Business with Insurance

- Liability insurance: Protects against claims related to your work.

- Health insurance: Consider your options for healthcare coverage as a freelancer.

- Maintain a Healthy Work-Life Balance

- Set realistic work hours: Avoid burnout by setting and adhering to a work schedule.

- Plan for vacations: Include time off in your financial planning to ensure a healthy work-life balance.

Remember, this checklist is a starting point. As a freelancer, your financial needs and goals are unique. At Jason Arsenault CPA, LLC, we believe in creating customized financial strategies that work for you. Whether it’s setting up the perfect budgeting system, planning for taxes, or saving for the future, we’re here to guide and support you every step of the way. Let’s work together to turn your freelance passion into a thriving and financially stable business.

Empowering Your Freelance Journey with Expert Guidance

The life of a freelancer is filled with both freedom and challenges. While the flexibility and independence are unparalleled, the financial complexities can sometimes feel overwhelming. But you’re not alone on this journey. At Jason Arsenault CPA, LLC, we understand the unique financial needs of freelancers like you, and we’re committed to helping you navigate these waters with confidence and ease.

Why Choose Us?

- Personalized Attention: We know that no two freelancers are alike. That’s why we offer tailored advice and solutions to fit your specific needs.

- Expertise in Freelance Finances: With years of experience working with freelancers across various industries, we bring a wealth of knowledge and insights to the table.

- Proactive Approach: We don’t just react to problems; we help you anticipate and plan for them, ensuring you’re always a step ahead.

- Tools and Resources: From budgeting to tax planning, we equip you with the tools and knowledge you need to succeed.

- Ongoing Support and Guidance: We’re here for you throughout the year, not just at tax time. Whether it’s a quick question or in-depth planning, we’re just a call or email away.

Take the Next Step

Imagine a world where financial stress is no longer a barrier to your creative pursuits. Where tax season doesn’t fill you with dread. Where you can focus on what you do best – creating and innovating – while we handle the financial complexities. That world is within your reach.

Join the community of freelancers who have transformed their financial journey with Jason Arsenault CPA, LLC. Whether you’re just starting out or looking to take your freelance business to the next level, we’re here to help you achieve your financial goals.

Ready to Start?

Take the first step towards financial peace of mind. Contact us today to schedule a consultation. Together, we’ll explore how we can support your freelance career, tailor a financial plan that suits your lifestyle, and set you on a path to greater success and stability.

Your passion is your work; our passion is making your work financially rewarding. Let’s collaborate and create a thriving future for your freelance business.